Of course, you can have investments and savings that exist outside of these official account types. Most would consider their stock or open mutual fund portfolio or cryptocurrency accounts and even income properties themselves as retirement account. They are investments, yes indeed, but not explicitly classified as retirement accounts.

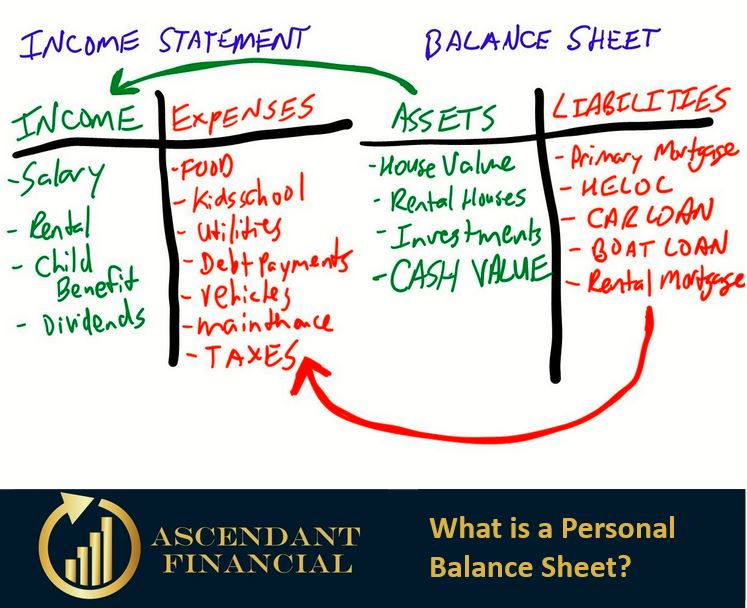

Start by filling in your basic information, such as your name, job description, and contact details. Just as the description suggests, you should then list your assets and liabilities. Think of every income and investment stream, such as real estate investments, annual salaries, and retirement plans. Possible assets include:

- Bank accounts balances

- Guaranteed Interest Certificates (GICs), bonds and treasury bills

- Valuables such as jewelry

- Gold, silver, bullion or other precious metal assets

- Real estate investments, what are they worth if you sold them today

- Investment accounts such as RRSPs, TFSAs, RESPs, RDSPs, LIRAs, any company or union pensions, mutual fund, segregated funds, stocks and even the very popular cryptocurrency accounts

- receivables from your business (people who owe you money)

- Loan assets, where you have lent money to someone, such as a second mortgage on a property, where you are the bank, not the borrower. This could even include a shareholder loan to your corporation or a business you own that needs to pay your back.

- And the least known asset that is often the most powerful on your balance sheet is cash value from life insurance policies.

Additionally, if you are trying to appease the bank for financing purposes, you may add up some other depreciating personal items. In the real financial world, no one truly considers these assets…but your bank wants to know everything they could possibly take collateral on. Therefore you can also total up these type of items:

- Car's and trucks

- motorcycles

- RV's, camping trailers

- Recreation vehicles like boats, snowmobiles, quads, etc

Liabilities, on the other hand, diminish your net worth. They will show up in another column and get subtracted from the total of all your assets. They may include:

- Outstanding loans

- Mortgages and Home Equity Lines (HELOC)

- Credit card balances and personal credit lines

- Outstanding federal, provincial taxes or property taxes

- Personal debts, such as a loan from a parent

- Bank overdraft accounts

Today, there is a current need for individuals to determine their worth. However, most Canadians do not realize that Par Whole Life Insurance Cash Value should be listed as their assets. It is basically just like home equity. Par Whole Life Insurance Cash Value could be your best-performing asset. What's more, it could supplement or, better yet, replace your retirement income. Continue your journey of learning and discover more about this powerful asset class.

Check out our videos, podcasts, and articles to get a deeper insight into why Par Whole Life Insurance Cash value is one of your best assets.