Sound financial planning is vital to grow, look after and secure your assets. Life insurance is a way of securing your assets and dealing with future obligations – over a fixed term or a lifetime. As you age, you have more financial responsibilities like paying a mortgage and raising a family.

There are two primary types of permanent life insurance contracts. One is not as “permanent,” as the name suggests. We are referring to Universal Life Insurance. Universal Life started in the very late 70s and early 80s in Canada. It quickly became a popular product with a ton of marketing behind it from the industry. It has been sold heavily in the last 40 years since its inception… but is often confusing to the policy owner. Most folks who own this product don't fully understand how to utilize it. Even worse, they are thoroughly confused by the complex statements. It is no surprise, they are unaware of the potential pitfalls that may exist in its design.

Ultimately, it is a term insurance to age 100 policy with an investment or side fund component. Some have referred to it as a “term insurance policy with a vegas style slot machine attached to it.” Basically, the policy owner gets a contact based on a layer of term coverage to age 100 and then chooses some type of investment options available within that particular life company. In a perfect world, magic ensues, and the grand hope is that this will achieve some market growth as the policy owner ages. I'm sure you will recognize that our best-laid plans don't always work out as intended when markets are involved.

The problem with this form of permanent insurance is that it is a product that people don't fully understand. The two most significant issues that seem to arise are the confusion over the cost of insurance charges and hefty surrender charges.

When people are concerned about surrender charges in a life policy, the real culprit has been Universal Life. There are usually very high surrender charges if you want to cancel a Universal Life (UL) policy in the early years. In this situation, it generally erodes much of the value accumulated in the first 10 years. These charges can suck for the policy owner. Still, the reality is they are built into the contract to make sure the policy is actuarially protected for the insurance company. The Insurance company must recover costs of staff, admin, underwriting, etc., to acquire a new policy over the first ten years. If they do not, they will be unable to maintain claims when needed for the policy owners. This is one of the significant differences between Universal Life and Whole Life. Whole life policies do not have surrender charges.

In essence, as the insured individual ages closer and closer and closer to age 100, the costs to the insurance company to supply that amount of death benefit to that person increases as they are getting nearer eventual mortality. These rising internal insurance costs tend to erode much of the value of the built-up savings/investment component, if any, has accumulated. This has been the cause of several lawsuits in the United States. Many people who expected to have a death benefit at the end of their lives find out they no longer have it. The rising internal actuarial costs have become so tremendously high that they could no longer keep those policies in force, even though they were still alive.

That leads to the next most common problem also associated with the typical ART/YRT design. The policy owner is generally shown at the beginning how these plans can help provide the possibility of retirement income later in life. These projections have shown much higher returns on the investment component (the policy owner's responsibility to manage) than people have actually experienced. Lives change, markets change, and if the policy is not funded well or the market investments do not provide consistent growth, insurance costs eat up the fund value. The result is UL policies that “implode” on themselves in the later years when the owner and the owner's family need them the most.

In essence, as the insured individual ages closer and closer and closer to age 100, the costs to the insurance company to supply that amount of death benefit to that person increases as they are getting nearer eventual mortality. These rising internal insurance costs tend to erode much of the value of the built-up savings/investment component, if any, has accumulated. This has been the cause of several lawsuits in the United States. Many people who expected to have a death benefit at the end of their lives find out they no longer have it. The rising internal actuarial costs have become so tremendously high that they could no longer keep those policies in force, even though they were still alive.

That leads to the next most common problem also associated with the typical ART/YRT design. The policy owner is generally shown at the beginning how these plans can help provide the possibility of retirement income later in life. These projections have shown much higher returns on the investment component (the policy owner's responsibility to manage) than people have actually experienced. Lives change, markets change, and if the policy is not funded well or the market investments do not provide consistent growth, insurance costs eat up the fund value. The result is UL policies that “implode” on themselves in the later years when the owner and the owner's family need them the most.

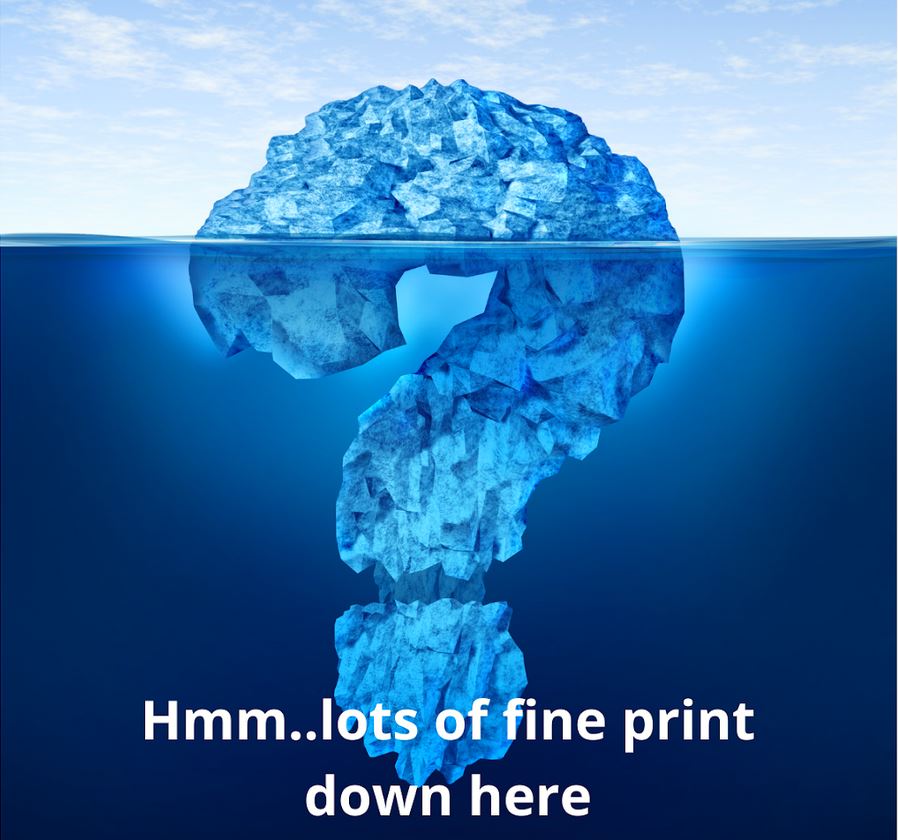

Universal Life, by definition in Canada, is considered a Permanent Life Insurance product. It is designed like all insurance by an actuary. The original premise of Univeral Life was to “unbundle” the guaranteed components and savings aspects of Whole Life insurance. With Whole Life, these are fully managed by the life company, and many guarantees are provided. UL, in essence, breaks those segments apart so that a policy owner can do it themselves. By unbundling all the items the Life company manages with a team of experts and handing those portions to the policy owner, the life company also hands-off managing the risk. The result is the risk of mortality charges and performance of any invested capital now lands on the shoulders of the policy owner. This can look good on paper as the initial premiums can entice people by being lower for the same starting amount of death benefit. Like an iceberg in the water, most of the real issue is hidden below the surface with UL policies.

Universal Life, by definition in Canada, is considered a Permanent Life Insurance product. It is designed like all insurance by an actuary. The original premise of Univeral Life was to “unbundle” the guaranteed components and savings aspects of Whole Life insurance. With Whole Life, these are fully managed by the life company, and many guarantees are provided. UL, in essence, breaks those segments apart so that a policy owner can do it themselves. By unbundling all the items the Life company manages with a team of experts and handing those portions to the policy owner, the life company also hands-off managing the risk. The result is the risk of mortality charges and performance of any invested capital now lands on the shoulders of the policy owner. This can look good on paper as the initial premiums can entice people by being lower for the same starting amount of death benefit. Like an iceberg in the water, most of the real issue is hidden below the surface with UL policies.

It might come as no surprise to read that there are class action lawsuits in the US against several insurance companies. Some have opted to settle out of court.

It might come as no surprise to read that there are class action lawsuits in the US against several insurance companies. Some have opted to settle out of court.

Financial planning is not about a product. It's about our objectives, and it's about what we want to see accomplished in our life. Having the right insurance as a tool in your toolbox is a powerful way to achieve those objectives. Insurance that you can utilize while you're alive is a game-changer for Canadians. With these living benefits, they no longer have to sacrifice the life they want to live now for a quality of life in their retirement

We have expert financial advisors and coaches that can help you Understand Universal Life Insurance.

©2023 Ascendant Financial All Rights Reserved | Terms & Privacy Policy | DMCA

© 2023 Ascendant Financial Inc. All rights reserved.

The supporting material, audio and video recordings and all information related to Introduction to Becoming Your Own Banker, The Infinite Banking Concept (IBC) posted on www.ascendantfinancial.ca and all other Ascendant Financial Inc. websites are designed to educate and provide general information regarding The Infinite Banking Concept (IBC) and all other subject matter covered. It is marketed and distributed with the understanding that the authors and the publishers are not engaged in rendering legal, financial, or other professional advice. It is also understood that laws and practices may vary from province to province and are subject to change. All illustrations provided in these materials are for educational purposes only and individual results will vary. Each illustration provided is unique to that individual and your personal results may vary. Because each factual situation is different, specific advice should be tailored to each individual’s particular circumstances. For this reason, the reader is advised to consult with qualified licensed professionals of their choosing, regarding that individual’s specific situation.

The authors have taken reasonable precautions in the preparation of all materials and believe the facts presented are accurate as of the date it was written. However, neither the author nor the publishers assume any responsibility for any errors or omissions. The authors and publisher specifically disclaim any liability resulting from the use or application of the information contained in all materials, and the information is neither intended nor should be relied upon as legal, financial or any other advice related to individual situations.

Family Banking System (FBS)™ is a trademark of Ascendant Financial Inc. © Ascendant Financial Inc., 2024. All rights reserved. The phrase “Live the Lifestyle, Love the Process, Infinite Banking” is a registered copyright (Registration No. 1209863) with the Canadian Intellectual Property Office. Unauthorized use, reproduction, distribution, or copying of this phrase, in whole or in part, without express written permission from Ascendant Financial Inc. is strictly prohibited. This copyright is protected under Canadian intellectual property laws and regulations. Any unauthorized use is subject to legal action and enforcement under Canadian law. For inquiries or requests for permission to use this copyright, please contact Ascendant Financial Inc.

The Infinite Banking Concept® is a registered trademark of Infinite Banking Concepts, LLC. Ascendant Financial is independent of and is not affiliated with, sponsored by, or endorsed by Infinite Banking Concepts, LLC.”

This content is intended for Canadian residents of BC, AB, SK, MB, ON, NB, and NS only.