TFSA contribution limit 2022

As you can see above, the current room available for 2022 follows the last two years at $6000. Many Canadians have far more space than this open. However, Canadians are seemingly getting more distrustful of governments in general and have concerns about the future of tax-qualified plans like the TFSA and RRSP. Much of this has to do with fears of the “bail-in” legislation in Canada. Following the Crisis of failing banks in Cyprus in 2012-2013 and Greece in 2009-2010 following the Financial Crisis, many western nations moved from bailout to bail-in legislation.

Famous bestselling Author R. Nelson Nash commented in his book Becoming Your Own Banker that tax-qualified plans provided by governments were akin to appointing the fox to guard the henhouse as he describes Willie Sutton's law. “Wherever wealth is accumulated, someone will try to steal it.”

For this reason, Canadians are learning that the original “tax-free savings” has always been Participating Whole Life Insurance. It has been around as a stabilizing force in the financial lives of Canadian families for over 170 years. Unlike the restrictions of a TFSA account, there are no limits imposed on the government to how much you can put in or take out as a Par Owner with a private contract.

What is the lifetime limit for TFSA?

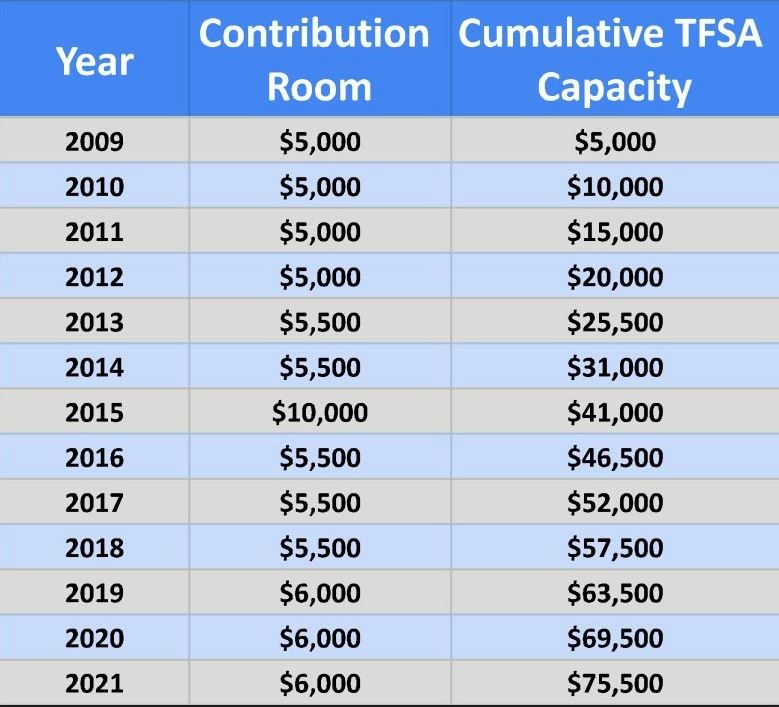

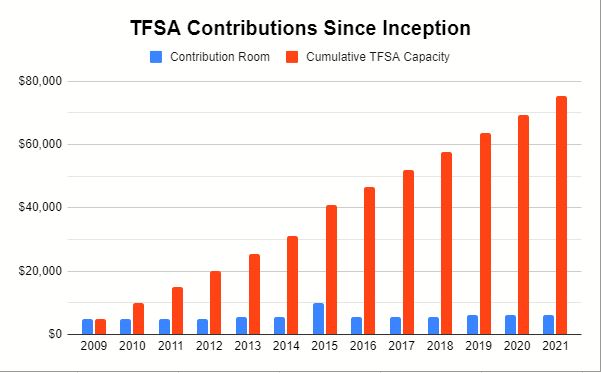

Using the chart on this article, you can see the cumulative total contribution room for the TFSA as of the 2022 calendar year is $75,500