Paid up additions Expert

Get Access To Our On-Demand Training To See How You Can Benefit From Paid up Additions.

PUA (PUAR) rider or simply the paid-up additions rider is a unique feature of insurance that has been discussed at length in designing a policy or system of policies that would enable the policy owner to properly implement The Infinite Banking Concept, developed by the late R. Nelson Nash. In this article, we’ll talk about paid-up additions and how it suits this often neglected, and often misunderstood, financial freedom tool known as participating dividend paying whole life insurance coverage.

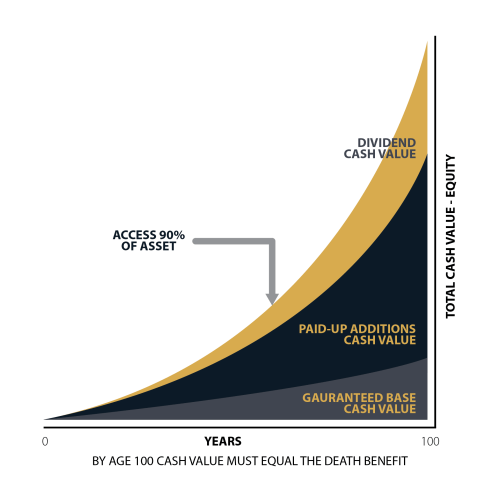

Paid Up Additions Cash Values Growing Ascendant

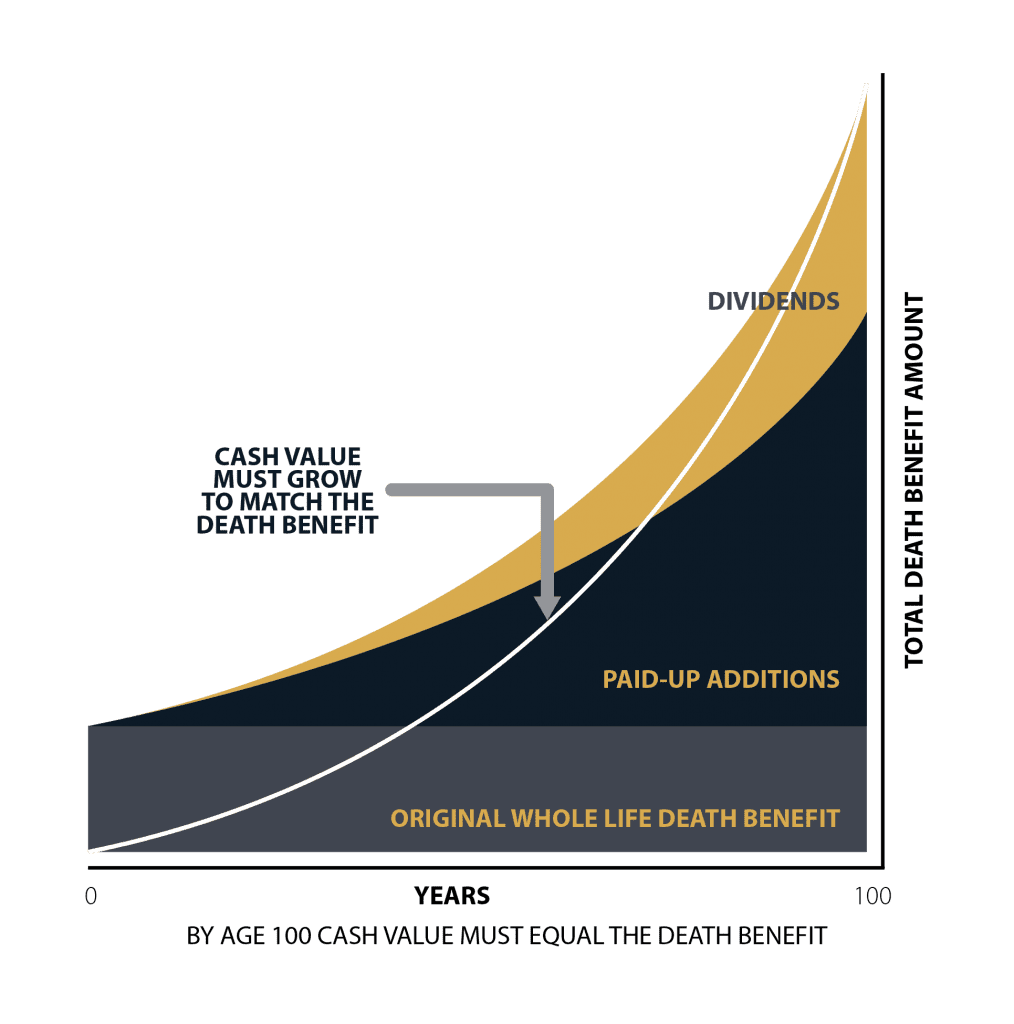

A paid-up addition (PUA) is another layer of death benefit that is added to a policy. Each PUA can be purchased by way of additional deposits (a.k.a. ADO or EDO), by dividends, or a combination of both. Each PUA also earns dividends every year they’re declared and each PUA must accumulate it’s equivalent in cash value by age 100 of the life insured. This additional growth is an advantage to the policy owner while the life insured is alive and when the life insured dies.

Now, that is a wordy definition, but it still seems difficult to understand, and it doesn’t define what it really is.

Now try imagining paid-up additions the same way as mini-paid up life insurance policies stacked on top of your original participating whole life policy.

Paid-up means exactly that. Once it’s purchased, you never pay anything for it again. What each PUA does is accelerate your daily cash value growth as well as your total death benefit.

For starters, Paid-Up Additions are a spec that exists in participating dividend paying whole life insurance. As mentioned above, they can be purchased with additional deposits of premium, dividends or a combination of both. When dividends are used to purchase PUA’s, there is no taxable event triggered.

You can decide to use dividends to purchase PUA’s or:

For the purposes of implementing the process of Becoming Your Own Banker, The Infinite Banking Concept, we elect to have dividends purchase paid up additions.

Because Paid-Up Additions (PUAs) speed up the increase of cash value inside a whole life insurance policy, they are essential to the infinite banking method . PUAs are used in infinite banking in the following ways:

PUAs give policyholders the option to pay more premiums toward fully paid-up insurance, which raises the policy's cash value and death benefit.

This offers a means of optimizing cash value accumulation while also overfunding the policy.

Dividends from the additional paid-up insurance acquired through PUAs can be utilized to fund the acquisition of more paid-up additions.

Over time, this compounding effect causes the monetary value to increase quickly.

In most cases, participating dividend paying whole life policies feature a rider that allows you to purchase these paid-up additions. Different firms have different names. For instance, you’ll come across names such as:

Every earned dividend goes to acquire paid up additions.

Paid up additions are used mainly because they help to:

The main reason why they are so popular is because they pay accumulate cash value daily and grow the death benefit simultaneously.

Albert Einstein is quoted as having said that “Compound interest is the eighth World Wonder.” We like to say that “Uninterrupted compounding is the ninth World Wonder”. And that is what you achieve inside the policy … daily uninterrupted growth.

As you may already know, compound interest results in exponential growth. Those who understand it, earn it. Those who don’t understand it, pay it.

Each paid-up addition increases cash value which consequently earns dividends in our (PUA) case. These dividends lead to additional paid-up additions, which end up earning dividends themselves. That’s a compounding factor that cannot be beat.

Get Access To Our On-Demand Training To See How You Can Benefit From Paid up Additions.

© 2024 Ascendant Financial Inc. All rights reserved.

The supporting material, audio and video recordings and all information related to Introduction to Becoming Your Own Banker, The Infinite Banking Concept (IBC) posted on www.ascendantfinancial.ca and all other Ascendant Financial Inc. websites are designed to educate and provide general information regarding The Infinite Banking Concept (IBC) and all other subject matter covered. It is marketed and distributed with the understanding that the authors and the publishers are not engaged in rendering legal, financial, or other professional advice. It is also understood that laws and practices may vary from province to province and are subject to change. All illustrations provided in these materials are for educational purposes only and individual results will vary. Each illustration provided is unique to that individual and your personal results may vary. Because each factual situation is different, specific advice should be tailored to each individual’s particular circumstances. For this reason, the reader is advised to consult with qualified licensed professionals of their choosing, regarding that individual’s specific situation.

The authors have taken reasonable precautions in the preparation of all materials and believe the facts presented are accurate as of the date it was written. However, neither the author nor the publishers assume any responsibility for any errors or omissions. The authors and publisher specifically disclaim any liability resulting from the use or application of the information contained in all materials, and the information is neither intended nor should be relied upon as legal, financial or any other advice related to individual situations.

Family Banking System (FBS)™ is a trademark of Ascendant Financial Inc. © Ascendant Financial Inc., 2024. All rights reserved. The phrase “Live the Lifestyle, Love the Process, Infinite Banking” is a registered copyright (Registration No. 1209863) with the Canadian Intellectual Property Office. Unauthorized use, reproduction, distribution, or copying of this phrase, in whole or in part, without express written permission from Ascendant Financial Inc. is strictly prohibited. This copyright is protected under Canadian intellectual property laws and regulations. Any unauthorized use is subject to legal action and enforcement under Canadian law. For inquiries or requests for permission to use this copyright, please contact Ascendant Financial Inc.

The Infinite Banking Concept® is a registered trademark of Infinite Banking Concepts, LLC. Ascendant Financial is independent of and is not affiliated with, sponsored by, or endorsed by Infinite Banking Concepts, LLC.”

This content is intended for Canadian residents of BC, AB, SK, MB, ON, NB, NS, NU, YT, PEI & NFLD only.