Old age security supplement

Those who qualify for OAS pension may also be eligible for the untaxed Guaranteed Income Supplement (GIS) allowance. All of these benefits, including OAS, are based on your age, marital status, and income. This is sometimes referred to as the old age security supplement.

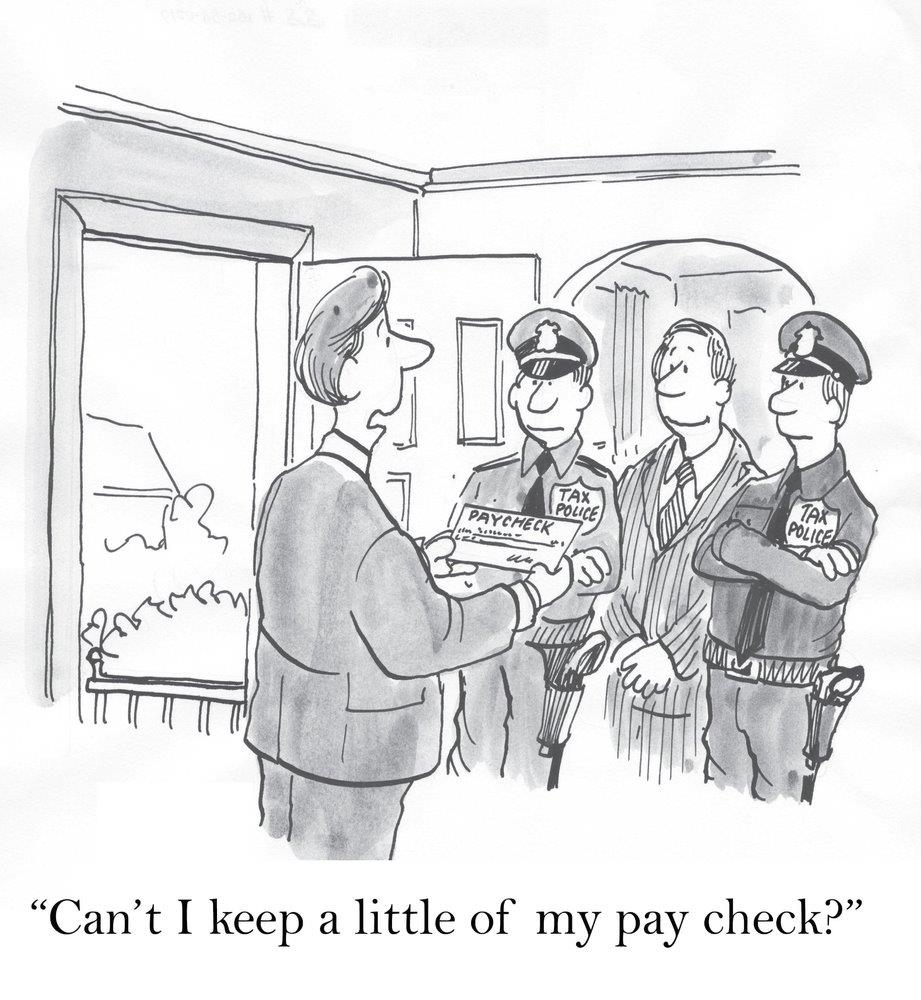

Unfortunately, if a Canadian senior has too much income in a given year, the government will claw back the amount they receive. That's why seniors need to have an additional insured retirement plan set up to draw out tax-free income. This can be a massive benefit for your retirement, as you can keep your OAS income while still drawing out untaxed income from an IRP. Careful planning from a year to year basis is needed to look at your various income sources that are taxable, such as RRSP or RRIF withdrawals, rental or dividend income, or the sale of property in a given year.

Old age security doesn't have to be so complicated, and neither do insured retirement plans. Sign up for our on-demand webinar training today to learn how to take control of your finances so you can create a stress-free retirement plan today.