Did you know that certain life insurance companies in Canada pay dividends annually to their participating whole life policy owners? Since 1848, Canadians who own these contracts have been receiving annual dividends each year without interruption. Yes, even during the Spanish Flu, the great depression, 30 recessions, H1N1, SARS, the financial crisis, and now COVID 19.

In order to receive these dividends, you or your company must be the owner of a dividend paying participating (PAR) whole life insurance policy, or a system of policies.

When most people hear the word “dividend”, they think of publicly traded stocks that are purchased and held inside an investment portfolio or brokerage account. However, many people are simply unaware they can receive dividends annually from Life Insurance Companies who sell participating whole life insurance contracts, and when structured properly, pay zero ($0) tax on those dividends. The annual dividend paid is based on each policy’s contribution to the net earnings of the life insurance company. And when it comes to mutually owned life insurance companies, there are no stockholders. The sole beneficiaries of the divisible surplus generated each year are the participating policy owners. You become a co-owner of the Life Insurance Company, one that has never failed to generate profit. The divisible surplus is paid out based on how each policy contributed to the overall surplus. This is known as the contribution principle.

There are also publicly traded life insurance companies in Canada and the stockholders participate in the profits generated along with the participating policy owners. In the late 1990s and early 2000s, many of the major life companies amalgamated. The participating owners chose to shift from a mutually owned carrier to a stock-owned carrier through a majority vote of the participating owners. For anyone who was already a participating owner (the only way you could be an owner at that time), they still maintained contractual authority, guarantees, and dividends. Additionally, they received either a cash windfall, stock (shares), or a combination of both in the new publicly traded company. For many, this was the equivalent of winning the lottery!

Today both mutual and publicly traded life insurance companies operate in Canada.

Dividends with participating whole life insurance in Canada have proven to be historically consistent over a long time. At the time this article was written, dividends have been declared and paid for one hundred and seventy three (173) consecutive years in a row to be exact. An added advantage is the control that each policy owner has over what they elect to do with their annual dividend. One option is the dividends can be chunked right back into the policy to purchase paid up additions (PUA) at no additional cost. This not only increases the total death benefit of the policy, but it also contractually guarantees an increase in total cash value. The reason is the total cash value is contractually guaranteed to match the total death benefit by age 100 of the life insured. What that means is everyday the life insured is aging closer to 100, the cash value is rising. And this increasing pool of cash value is accessible by the policy owner at anytime, either by policy loan, collateral assignment or withdrawal.

You may have heard a Financial Advisor or Life Insurance Agent say “wait a minute, dividends are not guaranteed”.

The only dividend that is not guaranteed is the one that hasn’t been declared yet.

On an annual basis, when a dividend is declared, it is contractually guaranteed to be paid, it cannot be repossessed and it cannot lose value. And when the dividend is used to increase the paid-up whole life death benefit, it creates a long term ripple effect where cash values are always growing and trying to catch up to the ever-increasing death benefit. This provides the policy owner with a much more significant impact than the actual dividend received in any given year.

The policy owner’s behavior is far more critical than the behavior of the Life Insurance Company.

Dividends are paid annually on the anniversary date of your policy. The policy year is not to be confused with the calendar year. They are declared by the life company, usually at the same time each year when they release their annual reports and then paid to the policy owners at their next upcoming anniversary. Once paid to the policy owner, it can never lose value or be taken away. It is immediately fully vested for the life of the policy.

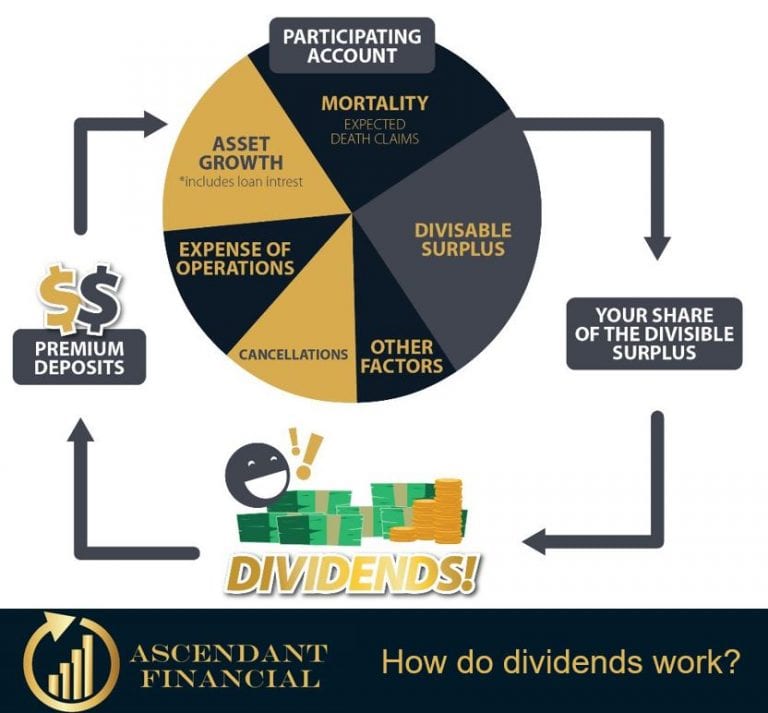

Yes, the dividends you receive on a participating (PAR) whole life policy are based on the value of the policy you have. The larger the policy, the larger your share of the divisible surplus. Many factors go into the actual dividend paid each year. The life company assesses how each policy contributed to the net earnings, a formula is applied and the actual dividend yield per policy is determined and then declared.

Dividends are paid out once a year to the participating accounts of policy owners on the policy anniversary. It is important to note that the only dividend that is not guaranteed is the one that hasn’t been declared yet. The amount to be paid out is determined by each policy’s contribution to the net earnings of the life insurance company.

In Canada, Life Insurance Companies are required to maintain “minimum continuing capital surplus reserves”, also referred to as a Life Insurance Capital Adequacy Test (LICAT) ratio. In other words, for all forecasted contractual obligations for a upcoming period, i.e. fiscal year, the insurance company is required to have minimum reserves of capital on hand to satisfy those obligations.

Each year, the money pool of the life insurance company, also known as the participating account is subjected to dynamic capital adequacy testing. Think of this process as a stress test. The money pool is subjected to a number of mock adverse scenarios such as more People dying than the actuaries forecasted, severe and prolonged economic / stock market decline, negative interest rates, increased lapse ratios, etc. A report is generated and provided to the Life Insurance Company and with favorable results, gives the board of directors confidence that dividends can be declared.

Before declaring a dividend, the accountants get together with the board of directors to review how the business was managed that year. What did we take in, what did we pay out, what’s left over. The returns generated by the participating account are then applied to a proprietary formula (dividend scale interest rate) to determine how to gradually bring those returns into the dividend yield over a period of time (years), also known as a smoothing effect. Insurance companies determine dividend allocation by looking at the present participating account surplus and comparing it with what it will be in the future. General projections are made to see what to expect in the short term (usually 4 to 5 years) and long-term (usually about 20 years). Once determined, dividends will be declared and paid.

What is a participating account surplus?

Excess earnings and profits are generated when a participating account’s performance is better than its expenses. This is called the participating account surplus. While factors such as cancellations (lapses), expenses, and claims experience (death claims) contribute to the surplus, the overall participating account’s investment returns also play a factor. The life company applies a “smoothing” method to blend great years and the years that are less profitable over a period of time. The result, par whole life performance has been so effective and consistent over a very long time.

What is a dividend scale?

Dividend scale interest rate is not to be confused with the actual dividend yield of any one policy. It is merely a measurement combined with a proprietary formula utilized to calculate what dividend yield each participating policy will receive on their next policy anniversary. The dividend scale is a formula that is based on the following factors:

It is common for the general public to assume that dividends of a participating (PAR) whole life insurance are equivalent to dividends of a normal investment or ROI (return on investment). This is a common misconception because no equation correlates the two and there is no relationship. Conversely, participating (PAR) whole life is very efficient. An insurance company takes a pool of money known as the participating account where the money is coming in and going out. They have money that is invested in both the short and long-term. They incorporate the ups and downs, the gains and losses of a market over several years, to maintain a stable and consistent declaration of dividends year after year, decade after decade, century after century.

A question like this is typically associated with assessing an investment, for example in the stock market, where the investor is assessing the yield (income) on a publicly-traded stock, or basket of stocks. Whether you are investing money on Wall Street or Bay Street in Canada with the TSX, it is beneficial to look at that as a factor when making investment decisions.

When it comes to the word “dividend” from a Life Insurance Company, we’re referring to the dividends paid to participating whole life policy owners. And because the policy is a unilateral contract, we’re not addressing the yield of an investment. Instead, we review what, as a policy owner, you may elect to do with your dividend each year. When you elect to use the dividend each year to purchased paid up additions (PUA) at no additional cost, the benefits become enormous in both total cash value accumulation and total death benefit. And, you do not trigger a taxable event.

What's better is that once that dividend is paid, it is fully vested, meaning it cannot be repossessed or lose value. And when applied as a paid-up addition as per the above,each paid up addition also receives a dividend every single year that dividends are declared. This creates a compounding effect inside the policy, shielded from tax and accumulating contractually guaranteed daily growth of cash value. This puts the policy owner in a position of total and absolute control. In contrast, when money is invested, it is always subject to the risk of loss.

And so when you hear the word dividend, rather than think “here comes revenue canada”, we encourage you to refer back to the advantages of dividend paying participating whole life insurance.

Get Access To Our On-Demand Training To See How Our Expert Financial Advisors And Coaches Can help you Earn Participating Dividends Consistently Throughout Your Lifetime. Enroll For The Participating Dividend Training And Discover How To Become Your Own Banker

© 2024 Ascendant Financial Inc. All rights reserved.

The supporting material, audio and video recordings and all information related to Introduction to Becoming Your Own Banker, The Infinite Banking Concept (IBC) posted on www.ascendantfinancial.ca and all other Ascendant Financial Inc. websites are designed to educate and provide general information regarding The Infinite Banking Concept (IBC) and all other subject matter covered. It is marketed and distributed with the understanding that the authors and the publishers are not engaged in rendering legal, financial, or other professional advice. It is also understood that laws and practices may vary from province to province and are subject to change. All illustrations provided in these materials are for educational purposes only and individual results will vary. Each illustration provided is unique to that individual and your personal results may vary. Because each factual situation is different, specific advice should be tailored to each individual’s particular circumstances. For this reason, the reader is advised to consult with qualified licensed professionals of their choosing, regarding that individual’s specific situation.

The authors have taken reasonable precautions in the preparation of all materials and believe the facts presented are accurate as of the date it was written. However, neither the author nor the publishers assume any responsibility for any errors or omissions. The authors and publisher specifically disclaim any liability resulting from the use or application of the information contained in all materials, and the information is neither intended nor should be relied upon as legal, financial or any other advice related to individual situations.

Family Banking System (FBS)™ is a trademark of Ascendant Financial Inc. © Ascendant Financial Inc., 2024. All rights reserved. The phrase “Live the Lifestyle, Love the Process, Infinite Banking” is a registered copyright (Registration No. 1209863) with the Canadian Intellectual Property Office. Unauthorized use, reproduction, distribution, or copying of this phrase, in whole or in part, without express written permission from Ascendant Financial Inc. is strictly prohibited. This copyright is protected under Canadian intellectual property laws and regulations. Any unauthorized use is subject to legal action and enforcement under Canadian law. For inquiries or requests for permission to use this copyright, please contact Ascendant Financial Inc.

The Infinite Banking Concept® is a registered trademark of Infinite Banking Concepts, LLC. Ascendant Financial is independent of and is not affiliated with, sponsored by, or endorsed by Infinite Banking Concepts, LLC.”

This content is intended for Canadian residents of BC, AB, SK, MB, ON, NB, NS, NU, YT, PEI & NFLD only.