Corporate tax, or the corporate income tax, is a tax that is levied on profits or incomes generated by businesses or corporations. Corporate taxes can be levied on income produced from the business activities and income produced on property such as investments. The government imposes a direct income tax on companies' earnings, usually based on taxable income.

Taxes are paid on the taxable income of a business. The taxable income of a business is the revenue which does not include cost-of-goods-sold, expenses for general and administrative purposes, sales and marketing, R&D, depreciation and other operating costs. Corporate tax differs between the different countries and some countries are considered to be tax havens due to their soft tax policies. It is also important to know that there can be deductions, government subsidies, and tax strategies that help with lowering the corporate taxes that are being paid.

Corporate tax has two purposes: to raise revenue for the government, and to distribute the tax burden among different economic entities. Tax rates are usually set by the government, and they can differ depending on the country and the size and type of profits.

Alberta and Quebec administer their own corporate income tax system. Corporations earning income in these provinces must file both provincial and federal income tax returns. CRA administers the corporate income tax for all other provinces.

The corporate tax is a major source of revenue and helps governments fund public services, infrastructure, and other expenditures. It is a crucial component of the tax system, and it is usually separate from the personal income tax that is levied by individuals.

The formula for the corporate tax calculator varies depending on the laws and regulations in each province or territory. However, here is a simplified formula to understand how the corporate tax is being calculated on active business profits.

Taxable income = Total revenue – Allowed Deductions + Exemptions

The corporate tax is calculated using the taxable income of the company. To determine the taxable income, subtract all allowable exemptions and deductions from a company's gross or total income.

After you calculate the taxable income you can use the corporate tax rates to determine how much tax you owe. The government sets the corporate tax rate, which is expressed in percentages.

Tax Due = Taxable Income * Corporate Tax Rate

Knowing this is fundamental to calculating the right tax bill you have to pay to the Canada Revenue Agency.

Most corporations in Canada will have to pay corporate income tax. Even if your corporation isn’t actually in Canada, you may still have to pay corporate income tax in Canada if you’re a corporation. Taxation in Canada is based on a set of detailed frameworks that primarily cover purpose, jurisdiction, and residency.

Based on these general frameworks, they will fall into specific taxation rules and exemptions while taking into consideration the size of the corporation.

Canada’s Income Taxation system is a progressive system which means the more income you produce and generate, the more taxes you pay. This is consistent in the personal and corporate environment.

The most common corporation that Canadians associate with is a standard operating company. Based on the size of your business and province you’re in, the baseline tax rate for all corporations is 38% called a Part 1 Tax. Income earned within Canada is eligible for a federal tax abatement which drops the Part 1 corporate tax to 28%

Some corporations don’t have to pay corporate income tax. Tax-exempt Crown Corporations, Hutterite colonies, and registered charities are not required to file, or pay corporate income tax, but have their own unique filing obligations.

In broad scope, the types of Corporate Taxes can be generally categorized as Income Taxes on Active Income and Income Taxes on Passive Investment Income.According to the Canada Revenue Agency, the corporate tax rate is broken down into two: the federal rate and provincial/territorial rate.

The base rate is Part I Tax and it is 38% on your taxable income and 28% after Federal tax reduction.

After the general reduction in tax, the net tax is 15%.

The net tax rate for private Canadian corporations that claim the small businesses deduction is 9%.

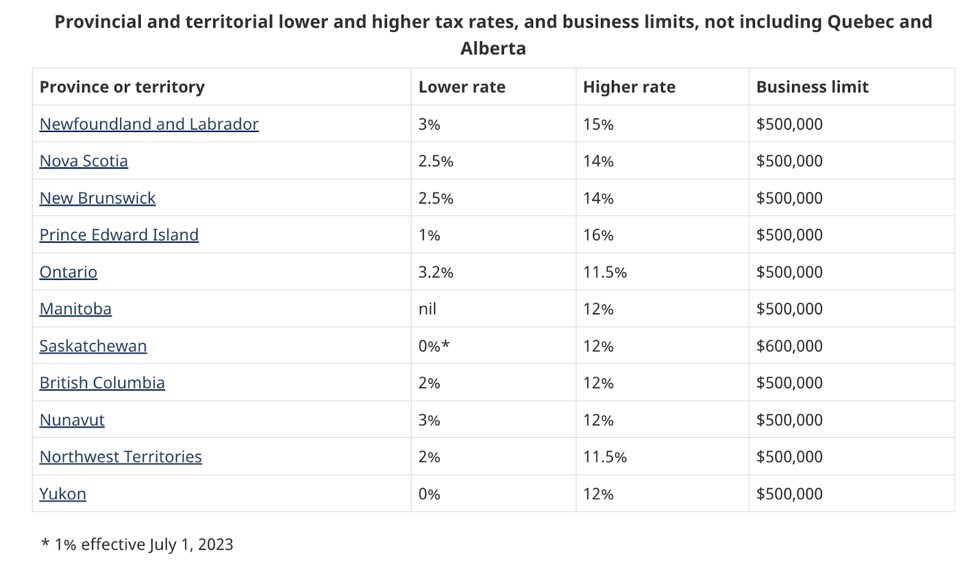

Rates for provincial or territorial territories

In general, provinces have two income tax rates – one lower and one higher.

The income that is eligible for the small business deduction will be taxed at a lower rate. The business limit is one component of the small-business deduction. Some provinces and territories use the federal small business limit. Some provinces and territories set their own limits.

All other income is subject to the higher tax rate.

Tax rates for provinces and territories (except Quebec and Alberta)

The table below shows the rates of income tax and business limits in each province and territory (except Quebec and Alberta , which do not have corporation tax collection agreements with the CRA ). These rates are valid as of January 1, 2023 and maybe subjected to changes:

The general corporate tax rate in Canada is 15% after federal tax abatement (10%) and general tax reduction (13%). Small businesses are subject to a federal tax rate that is reduced by 9%.

The corporate tax rate varies from province to province. In Ontario, corporate tax rates are 11.5%. Small business tax rates are 3.2%. The combined federal and province taxes paid on active income by corporations is 26.5%. For small businesses, it's 12.2%.

This is a substantial tax savings .

Small businesses are Canadian controlled private corporations (CCPCs), which qualify for the Small Business Deduction (SBD).Small business deductions provide corporations with a lower tax rate up to $500,000 in active business income. This can help businesses save up to $30,000. Businesses would have also reduced provincial taxes.This amount of $500,000 can be claimed by a corporation or a grouping of CCPCs that are related for tax purposes.The small business deduction is not available to everyone.Firstly, when taxable capital is above $10 million for a CCPC or group of CCPCs, the SBD will gradually be reduced. The SBD is removed once a CCPC reaches $15 million of taxable capital.The SBD currently reduces taxable income by $100,000 per $1 million. This program ends at $15,000,000 in taxable capital. The proposed changes would reduce the amount by $12,500 per $1 million in taxable capital.

A CCPC or group of CCPCs associated with it may be subject to an additional restriction on the SBD amount if their investment income exceeds $50,000 during a taxation period. The SBD amount is gradually reduced in these cases and eventually eliminated when investment income exceeds $150,000.

Corporate tax exemption gives businesses some subsidies on their tax bill. Businesses that qualify for them can take advantage of several exemptions from corporate taxes in Canada. These exemptions may help to reduce or even eliminate the corporate tax that a business must pay. Here are some of the most common exemptions from corporate taxes in Canada:

The Small Business Deduction is an important tax benefit available to small businesses that qualify. The Canadian-controlled private corporation (CCPC) can apply a lower rate of tax on their active business earnings. The federal SBD tax rate, which is set to expire in September 2021 according to my knowledge, is 9%. However, it may vary from province to province.

The Canadian government offers various tax credits for investments in certain sectors or activities to encourage businesses to invest. These credits can be used to offset some of the taxes due. Examples include the Scientific Research and Experimental Development Tax Credit (SR&ED), which supports research and development, and the Film or Video Production Tax Credit which supports the film and TV industry.

Certain provinces and territories, including Nova Scotia, New Brunswick and Manitoba, offer tax incentives to individuals or corporations who invest in small businesses that qualify. These credits may provide an incentive for investment, and reduce overall tax liabilities.

The provinces and territories of Canada may provide additional tax incentives, exemptions, and other benefits that are specific to the jurisdictions they represent. These incentives are available in a variety of forms and can be targeted at specific industries, areas, or activities. Tax credits can be given for manufacturing, film production, technology innovation or resource exploration.

For the latest information on the corporate tax exemptions available in Canada, it's best to consult a qualified tax professional or to refer to the Canada Revenue Agency.

One way that you may pay less corporate tax in Canada is by implementing the Infinite Banking Concept. By creating your personal banking system, you are able to recapture the interest that you are giving away when you pay your taxes.

Other considerations to minimize corporate taxes in Canada:

Working closely with a professional tax advisor who understands Canadian tax laws will help you identify legal deductions and strategies that could lower your corporation's tax liability. Ensure that you are taking advantage of all the eligible expenses and deductions allowed by the Canada Revenue Agency. This may include business costs, capital cost allowances and research and development credit.

Make sure you are aware of all the tax incentives and credits that Canada offers. They could include tax credits for hiring employees, research and development, and investing in certain industries or regions.

It may be more advantageous to pay dividends than bonuses or salary, depending on your circumstances. Dividends can be taxed at different rates, which may result in a lower tax bill for shareholders.

How your business is organized can affect your tax obligations. Tax professionals can help you determine whether a different corporate form, such as incorporation as a small-business corporation (SBC), or the use of a holding company could provide tax benefits in your situation.

Tax laws can be complex and are subject to change. It is important to consult a tax professional to get personalized advice that takes into account your unique circumstances and the latest tax regulations in Canada. If you are interested in understanding how the Infinite Banking program can help keep taxes away from your wealth, watch our training below.

Get Access To Our On-Demand Training To See How You Can Further Understand The Role Of Beneficiaries.

© 2024 Ascendant Financial Inc. All rights reserved.

The supporting material, audio and video recordings and all information related to Introduction to Becoming Your Own Banker, The Infinite Banking Concept (IBC) posted on www.ascendantfinancial.ca and all other Ascendant Financial Inc. websites are designed to educate and provide general information regarding The Infinite Banking Concept (IBC) and all other subject matter covered. It is marketed and distributed with the understanding that the authors and the publishers are not engaged in rendering legal, financial, or other professional advice. It is also understood that laws and practices may vary from province to province and are subject to change. All illustrations provided in these materials are for educational purposes only and individual results will vary. Each illustration provided is unique to that individual and your personal results may vary. Because each factual situation is different, specific advice should be tailored to each individual’s particular circumstances. For this reason, the reader is advised to consult with qualified licensed professionals of their choosing, regarding that individual’s specific situation.

The authors have taken reasonable precautions in the preparation of all materials and believe the facts presented are accurate as of the date it was written. However, neither the author nor the publishers assume any responsibility for any errors or omissions. The authors and publisher specifically disclaim any liability resulting from the use or application of the information contained in all materials, and the information is neither intended nor should be relied upon as legal, financial or any other advice related to individual situations.

Family Banking System (FBS)™ is a trademark of Ascendant Financial Inc. © Ascendant Financial Inc., 2024. All rights reserved. The phrase “Live the Lifestyle, Love the Process, Infinite Banking” is a registered copyright (Registration No. 1209863) with the Canadian Intellectual Property Office. Unauthorized use, reproduction, distribution, or copying of this phrase, in whole or in part, without express written permission from Ascendant Financial Inc. is strictly prohibited. This copyright is protected under Canadian intellectual property laws and regulations. Any unauthorized use is subject to legal action and enforcement under Canadian law. For inquiries or requests for permission to use this copyright, please contact Ascendant Financial Inc.

The Infinite Banking Concept® is a registered trademark of Infinite Banking Concepts, LLC. Ascendant Financial is independent of and is not affiliated with, sponsored by, or endorsed by Infinite Banking Concepts, LLC.”

This content is intended for Canadian residents of BC, AB, SK, MB, ON, NB, NS, NU, YT, PEI & NFLD only.